One Year Later, TRID Causes FrustrationBy Ken Fears, Director, Regional Economics and Housing Finance NATIONAL ASSOCIATION OF REALTORS®

TRID - TILA/RESPA, the Truth In Lending Act and Real Estate Settlement Procedures Act - or the “Know Before You Owe” rules which now govern the mortgage settlement process were implemented on October 3, 2015. With a year of experience under TRID in hand, the National Association of REALTORS® surveyed its members for their perspective on the new process.

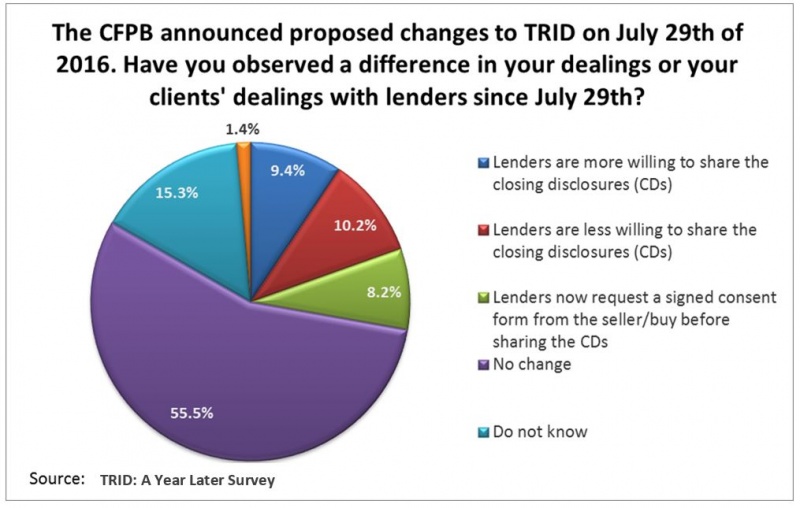

While delays in the 3rd quarter of 2015 had fallen relative to the period immediately after implementation of the rule in the 4th quarter of 2015, cancellations inched upward. Furthermore, when delays occurred, buyers and sellers were hit with expenses including additional rent or mortgage payments, lost vacation time or income, storage fees, and lost deposits which totaled to $410 on average. Likewise, REALTORS®’ costs increased by $154 per transactions over this period, while hours worked per transaction more than doubled. Inventory shortages could have impacted these increases, but NAR members voiced frustrations with significant delays in the lending process and communication issues with lenders suggesting that time spent per transaction did rise. REALTORS® had greater success getting access to the closing disclosure (CD) in the 3rd quarter than in the fall of 2015, but 45.6 percent of respondents still had issues getting access to the CD. Many NAR members voiced frustration as the new procedures made it more difficult for them to counsel their clients on the settlement process. One survey taker noted that, “…this new TRID experience has removed me from a lot of the process making me feel my relationships are suffering as a result…and the client is ultimately the one who loses that great service.” As a result, NAR members shifted to seeking the CD from title or closing agents or from their clients directly instead of from lenders. This trend was particularly evident among more active agents. Despite the Consumer Financial Protection Bureau’s (CFPB’s) clarification that there was no legal basis for lenders to withhold the document, the lenders’ top reason for not sharing the CDs were “lending law” (25.1 percent) and “privacy concerns” (28.0 percent). One respondent noted that, “most of the problems come from agents and banks that are unwilling to share the information because it is ‘illegal’. I spend a lot of time arguing that it is not, buyer agrees to share it in contract, vs bank and other agent saying it cannot be shared.” Large retail banks were the most problematic lenders according to respondents, whereas REALTORS® gave much better marks to small local banks, credit unions, and non-banks. When REALTORS® did get access to the CDs, 50.6 percent indicated finding errors on at least some of the CDs, up from 43.3 percent in the 4th quarter of last year. These errors included missing taxes, HOA dues, or concessions as well as incorrect escrow amounts, addresses, buyer or seller information, and commissions. Furthermore, when NAR members did not get access to the CDs, settlements often took longer. Overall, 61.7 percent of respondents indicated that the new process under TRID was more difficult than before and, “very confusing for the client when they are given various estimates throughout the process.” However, several respondents lauded the safety, protections, and clarity provided to consumers and one opined that, “we are creatures of habit and hate changes. Once I had about 3 closings under TRID, it all was like my first closing 13 years ago. I don't see a problem now...” The transition has been difficult for consumers and REALTORS® alike, but consumers have benefited and REALTORS® are adapting. Still, more needs to be done to smooth the settlement process and to allow NAR members to support consumers.   Ken Fears is the director, Regional Economics and Housing Finance National Association of Realtors®. Ken Fears is the director, Regional Economics and Housing Finance National Association of Realtors®. |

Today's Top Stories |