Gen X and HomebuyingBy Meredith Dunn, Research Communications Manager, NATIONAL ASSOCIATION OF REALTORS®

It’s true that millennials are the largest group of homebuyers and have been featured heavily in the news, partly due to recent discussions about student debt and delays in homeownership[1]. However, Gen X is also an important generational group: they comprise 26 percent of recent buyers and are the most racially and ethnically diverse population of buyers[2]. They are also in their peak income-making years, have the highest median priced home of all other buyers, and the largest homes in median square footage and number of bedrooms. According to the latest HOME (Housing Opportunities and Market Experience) Survey, released last month from the National Association of REALTORS® (NAR), 88 percent are more certain than millennials that buying a home is a good financial decision (compared with millennials’ 83 percent), and 59 percent are also more likely to feel that they can’t afford it (compared with millennials at 47 percent).

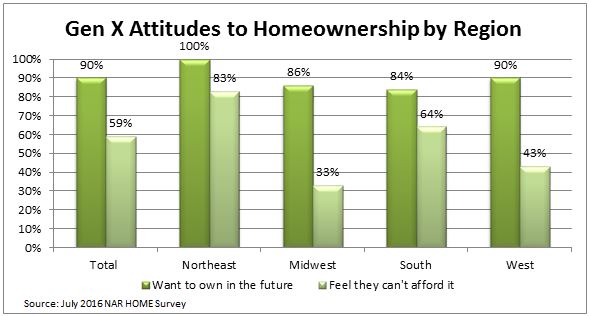

When asked whether homeownership is part of their American dream, 84 percent of Gen X respondents who answered yes barely beat out millennials who answered yes at 83 percent. Seven in 10 Gen X respondents own a home rather than rent or live with someone, but out of all the generations, Gen X is most likely to reply that the main reason they don’t own a home is because they can’t afford it (59 percent). The second-most likely reply is that they need the flexibility of renting—a trend they share with millennials although to a lesser degree (21 percent compared to millennials’ 26 percent). The circumstances that would have to change for Gen X to become homeowners in the future were twofold: an improvement in their financial situation, or a lifestyle change such as marriage, starting a family or new job situation, both tied at 30 percent. Looking regionally tells a similar story. In the Northeast, 100 percent of Gen X wants to own a home in the future while 83 percent feel they can’t afford it. In the Midwest, 86 percent wants to own a home in the future while 33 percent feel they can’t afford it. In the South, 84 percent want to own in the future while 64 percent feel they can’t afford it. Finally, in the West, 90 percent want to own in the future while 43 percent feel they can’t afford it. Gen X is the most likely of the generations to report that home prices have gone up in their local communities at 59 percent. However, Gen X respondents at 73 percent are more optimistic than millennials at 65 percent that now is a good time to buy. They also share some optimism that there is improvement on the horizon: they are more confident than the national median that their personal finances will improve in the next six months, and are the second-most likely to reply (after millennials) that the economy is improving.  For more information on the latest NAR HOME Survey results, click here. [1] 2016 Student Loan Debt and Housing Report [2] 2016 Home Buyer and Seller Generational Trends Report  Meredith Dunn is research communications manager for the National Association of REALTORS®. Meredith Dunn is research communications manager for the National Association of REALTORS®. |

Today's Top Stories |