How Many Hours Do You Have to Work to Afford Your Mortgage?By Paige Tepping

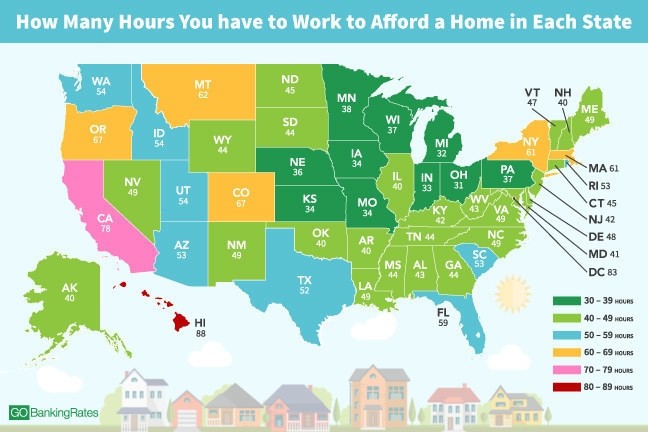

When you take your monthly mortgage payment, utility bills and other expenditures into consideration, it’s no surprise that owning a home is an expensive proposition. But have you ever considered just how many hours you have to work to afford your home? Or how many hours you’d have to work to afford your dream home in Hawaii? (Spoiler alert: don’t buy your plane ticket quite yet!).

In fact, if you’re looking to leave the hustle and bustle of city life behind and hang 10 in Hawaii, you better be prepared to put in some long hours. According to a study conducted by GOBankingRates—which looked at home listing prices, mortgage rates and household incomes—Hawaii tops the list of states where you’ll have to work the most to afford a mortgage, coming in at 88.13 hours a month. On the same side of the coin are the District of Columbia (83.29 hours a month), California (78.13 hours a month) and Colorado (67.02 hours a month). For those who can’t get enough of the great state of Ohio, you may just be in luck. The Buckeye State tops the list of places where you need to work the least to afford a mortgage at 30.76 hours a month. Next on the list is Michigan at 32.44 hours a month, Indiana at 32.72 hours a month and Iowa at 33.81 hours a month. If you have moving on the mind, be sure to check out the infographic below before you make your decision!  For more details regarding the study, visit www.gobankingrates.com. This post was originally published on RISMedia's blog, Housecall. Check the blog daily for top real estate tips and trends. |

Today's Top Stories |