Pending Home Sales Reaching Historic Highs Despite DipBy RISMedia Staff

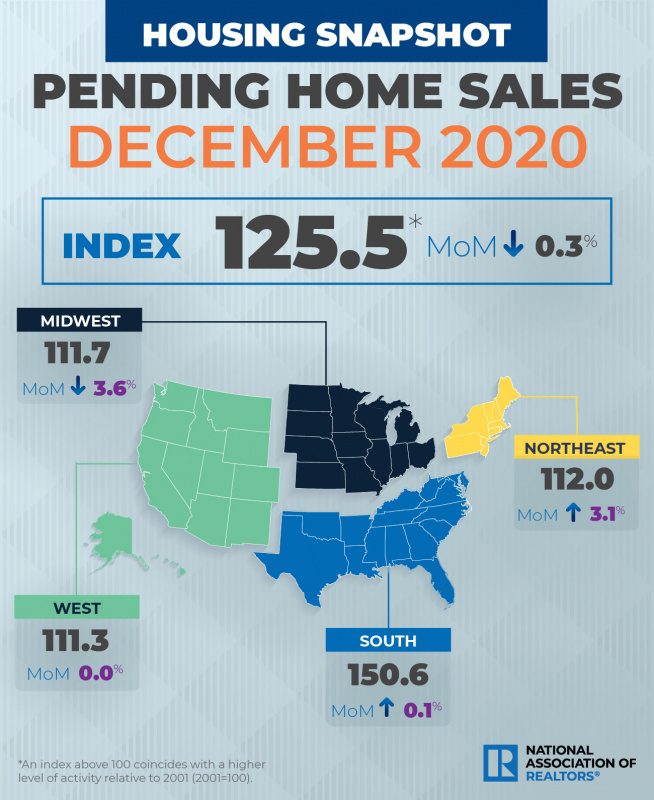

Pending home sales decreased by 0.3 percent in December, according to the National Association of REALTORS® (NAR) Pending Home Sales Index (PHSI), which came in at 125.5. However, year-over-year, contract signings have jumped 21.4 percent, and for December, this is still the highest ever registered.

Regionally, activity declined in one of the four major areas (the Midwest), while activity climbed (in the Northeast and South) or remained flat (in the West) in the other three.  Regional Breakdown: Northeast +3.1% MoM – Now 112.0 PHSI +22.1% YoY Midwest -3.6% MoM – Now 111.7 PHSI +13.9% YoY South +0.1% MoM – Now 150.6 PHSI +26.6% YoY West Unchanged MoM – 113.3 PHSI +19.9% YoY What the Industry Is Saying: "Pending home sales contracts have dipped during recent months, but I would attribute that to having too few homes for sale. There is a high demand for housing and a great number of would-be buyers and, therefore, sales should rise with more new listings. This elevated demand without a significant boost in supply has caused home prices to increase and we can expect further upward pressure on prices for the foreseeable future. I expect the 30-year fixed mortgage rate to average 3 percent, with the Federal Reserve refraining from any rate increases this year. There will also be slower home price appreciation, likely 6.6 percent, as increased confidence from homebuilders will ultimately lead to an increase in housing starts." — Lawrence Yun, National Association of REALTORS® Chief Economist "Demand for existing homes remains strong but supply is likely restraining sales figures. We had a fairly strong Q1 in 2020, so we may see year-over-year growth slow some until we hit April when the pandemic had its largest negative impact on home sales. We expect to see continued price acceleration in the near term as a result of record-low inventory levels that have persisted for several months now. Real estate has benefited from the unequal impact the pandemic has had across the economy. "The industries most severely impacted are those which typically have not paid wages high enough to enable homeownership, while high-paying sectors have seen far less loss of employment and high earners appear to have increased savings. This employment stability and increased savings in concert with historically low interest rates have led to a substantial uptick in demand, resulting in a year-over-year increase in existing home sales despite the pandemic. It may be several months before substantial progress is made in terms of available supply, and price growth will likely continue to accelerate until conditions improve." — Ruben Gonzalez, Keller Williams Chief Economist For more information, please visit www.nar.realtor. |

Today's Top Stories |